Offshore Company Formation: Professional Tips and Insights

Offshore Company Formation: Professional Tips and Insights

Blog Article

Expert Insights on Navigating Offshore Firm Development Efficiently

The complexities involved in navigating the intricacies of offshore company development can be discouraging for also experienced business owners. As we delve into the nuances of picking the right territory, understanding legal needs, taking care of tax ramifications, developing banking partnerships, and guaranteeing conformity, a wealth of understanding waits for those looking for to master the art of offshore business development.

Choosing the Right Territory

When thinking about overseas firm formation, selecting the ideal jurisdiction is a crucial choice that can considerably influence the success and procedures of business. Each jurisdiction provides its very own collection of legal structures, tax guidelines, privacy legislations, and financial rewards that can either prevent a company or benefit's objectives. It is important to carry out detailed research study and look for professional assistance to make certain the chosen jurisdiction lines up with the firm's objectives and needs.

Elements to think about when picking a jurisdiction include the financial and political security of the region, the ease of doing service, the degree of monetary personal privacy and discretion used, the tax obligation implications, and the regulative setting. Some territories are recognized for their favorable tax obligation frameworks, while others focus on personal privacy and property defense. Recognizing the unique attributes of each territory is crucial in making an informed decision that will support the long-term success of the overseas business.

Inevitably, picking the ideal territory is a critical action that can give possibilities for development, possession security, and functional performance for the offshore company.

Recognizing Lawful Demands

To make sure conformity and authenticity in overseas firm formation, a thorough understanding of the lawful needs is essential. Various jurisdictions have varying lawful structures controling the establishment and operation of offshore business. Staying notified and up to date with the legal landscape is important for efficiently browsing overseas firm formation and making sure the lasting sustainability of the business entity.

Navigating Tax Implications

Understanding the intricate tax obligation effects connected with offshore firm development is vital for making certain conformity and enhancing monetary techniques. Offshore business typically offer tax obligation advantages, yet navigating the tax landscape requires comprehensive knowledge and correct preparation. One crucial consideration is the idea of tax residency, as it identifies the territory in which the business is tired. It's necessary to comprehend the tax legislations of both the overseas jurisdiction and the home country to stop double taxation or unplanned tax obligation effects.

Furthermore, transfer pricing laws should be carefully evaluated to make certain deals in between the offshore entity and associated events are carried out at arm's length to prevent tax obligation evasion complaints. Some jurisdictions supply tax rewards for specific markets or tasks, so comprehending these incentives can assist make the most of tax financial savings.

Furthermore, keeping up to day with progressing global tax laws and conformity needs is vital to prevent charges and maintain the firm's reputation. Seeking expert suggestions from tax experts or specialists with experience in overseas tax obligation matters can offer valuable understandings visite site and ensure a smooth tax planning process for the offshore company.

Establishing Banking Relationships

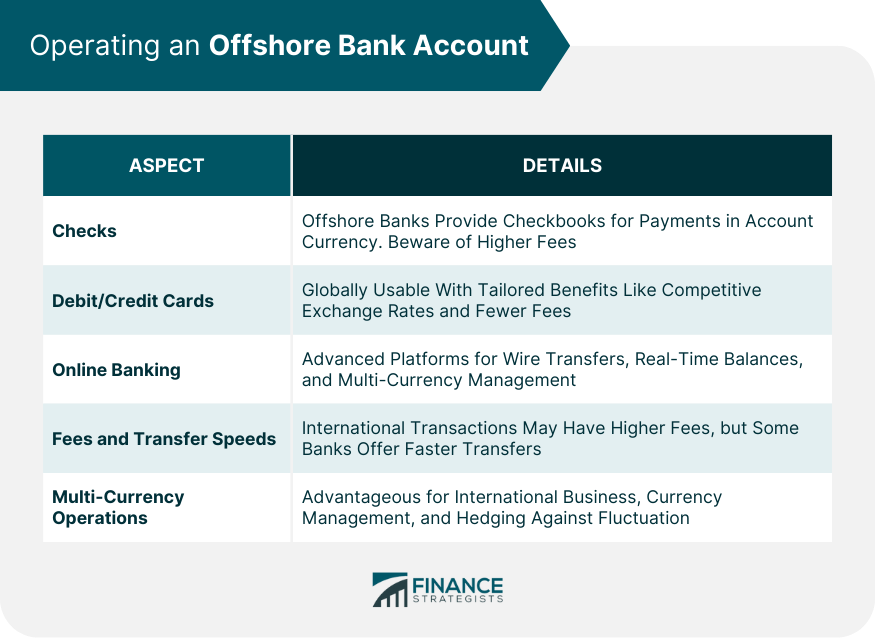

Establishing safe and trusted banking connections is a vital action in the procedure of overseas business formation. offshore company formation. When establishing up banking connections for an overseas firm, it is crucial to pick reliable banks that supply solutions tailored to the specific demands of worldwide organizations. Offshore firms frequently require multi-currency accounts, electronic banking centers, and seamless global transactions. Selecting a financial institution with a worldwide visibility and know-how in dealing with offshore accounts can enhance monetary operations and make certain compliance with international laws.

Additionally, prior to opening up a bank account for an offshore company, comprehensive due persistance treatments are usually called for to verify the legitimacy of business and its stakeholders. This might involve offering thorough documents regarding the business's activities, resource of funds, and advantageous proprietors. check over here Constructing a cooperative and transparent connection with the selected financial institution is key to navigating the complexities of overseas financial efficiently.

Guaranteeing Conformity and Coverage

After developing safe and secure financial partnerships for an overseas company, the next vital step is making sure compliance and reporting procedures are carefully followed. Involving financial and lawful specialists with expertise in overseas jurisdictions can help navigate the intricacies of compliance and reporting.

Failing to adhere to guidelines can lead to serious charges, fines, or perhaps the retraction of the overseas business's license. Remaining aggressive and watchful in making sure compliance and coverage requirements is essential for the long-term success of an overseas entity.

Conclusion

To conclude, efficiently navigating overseas company formation calls for careful factor to consider of the jurisdiction, legal requirements, tax obligation implications, financial connections, conformity, and reporting. By recognizing these vital elements and guaranteeing adherence to guidelines, organizations can establish a strong foundation for their overseas procedures. It is crucial to look for specialist advice and expertise to navigate the intricacies of offshore firm development efficiently.

As we dig find right into the subtleties of selecting the ideal territory, comprehending legal demands, taking care of tax effects, establishing banking relationships, and guaranteeing conformity, a wide range of expertise awaits those seeking to master the art of overseas company formation.

When considering offshore business formation, choosing the suitable jurisdiction is an essential choice that can significantly impact the success and operations of the service.Comprehending the complex tax obligation ramifications linked with overseas business development is critical for making sure compliance and optimizing financial techniques. Offshore companies often provide tax benefits, however navigating the tax obligation landscape requires comprehensive knowledge and correct planning.In final thought, successfully navigating offshore company formation calls for careful factor to consider of the territory, lawful needs, tax obligation effects, financial connections, compliance, and coverage.

Report this page